When it comes to safeguarding finances and ensuring tax compliance, it’s essential to have a working knowledge of legal tax planning techniques. Adopting a proactive approach to tax filing can help individuals and businesses minimize their tax obligations by leveraging government tax avoidance strategies. These strategies, built around IRS regulations and tax compliance best practices, can provide significant economic benefits.

This guide will provide valuable tax filing tips and insights for navigating the world of government tax avoidance and maintaining full legal compliance. Our goal is to empower you with the knowledge and confidence needed to make informed decisions and optimize your financial outcomes, all while adhering to the ever-evolving IRS regulations.

Understanding the Legal Landscape of Government Tax Avoidance

Tax avoidance and tax evasion are often misunderstood. It is crucial to clarify the differences between the two and understand how IRS regulations and authorized tax loopholes play significant roles in legal tax planning and compliance.

Clarifying the Difference Between Avoidance and Evasion

Tax avoidance refers to the strategic use of tax deductions and credits to legally lower tax liability. These methods, approved by Congress, help individuals and corporations save money on their taxes. In contrast, tax evasion involves illegal activities, such as underreporting income or falsifying deductions, and can lead to severe consequences, including fines and imprisonment.

Tax avoidance is considered responsible tax planning, while tax evasion is a criminal offense. It is essential to recognize that your tax-saving strategies must be in compliance with the law to avoid facing severe penalties.

The Role of IRS Regulations in Legal Tax Planning

The Internal Revenue Code, established by the IRS, serves as the foundation for legal tax planning. It outlines the rules and regulations taxpayers need to follow to ensure their tax-saving strategies align with federal requirements. By understanding IRS regulations and utilizing compliant tax strategies, taxpayers can legally reduce their tax obligations within the system’s bounds.

Adhering to income tax guidelines and IRS regulations is a key aspect of tax planning that ensures legal compliance and minimizes tax liabilities.

Utilizing Authorized Tax Loopholes for Compliance

Authorized tax loopholes are provisions within tax legislation that allow individuals and entities to legally reduce their taxes. Some examples of authorized tax loopholes include certain types of investments, retirement savings vehicles, and business expenses. Utilizing such loopholes is a compliant way to achieve tax minimization and optimize tax strategies.

Below is a table outlining various authorized tax loopholes that can help optimize tax planning:

| Tax Loophole | Description | Benefits |

|---|---|---|

| Mortgage Interest Deduction | Allows homeowners to deduct their mortgage interest on home loans up to a specified amount. | Helps reduce taxable income and encourages homeownership. |

| 401(k) and IRA Contributions | Allows individuals to contribute pre-tax income to retirement savings accounts. | Defers taxes on contributions and offers potential for tax-free growth until withdrawn in retirement. |

| Business Expenses | Enables businesses to deduct the cost of certain business-related expenses. | Reduces taxable income and rewards companies for making necessary investments to maintain operations. |

| Charitable Contributions | Provides tax benefits for individuals and corporations that donate to qualified charities. | Offers a tax deduction in line with the value of the donation made, effectively incentivizing charitable giving. |

Tax optimization strategies that leverage authorized tax loopholes can result in significant tax savings while maintaining legal compliance.

Tax Credits and Deductions: Your Pathway to Lower Liability

Lowering tax liability is a critical financial goal for both individuals and businesses. Through careful planning and utilization of tax-saving strategies, taxpayers can effectively reduce their tax burdens. Two key elements of these strategies are tax credits and tax deductions.

Tax credits and deductions serve different purposes, yet both offer significant benefits for reducing one’s tax liability. While tax credits directly reduce the amount of tax owed, tax deductions help decrease a taxpayer’s taxable income. The following sections outline various forms of credits and deductions that may be available, along with their specific benefits.

It is essential to understand the distinction between tax credits and tax deductions to optimize your tax-saving strategies effectively.

Tax Credits

Tax credits directly reduce the amount a taxpayer owes, offering more substantial benefits than deductions. Some common tax credits include:

| Credit | Description |

|---|---|

| Earned Income Tax Credit (EITC) | A refundable credit for low- to moderate-income working individuals and families. |

| Child and Dependent Care Credit | A credit for expenses related to the care of qualifying children and other dependents. |

| American Opportunity Tax Credit (AOTC) | A credit for eligible education expenses for the first four years of higher education. |

| Residential Energy Credits | A credit for making energy-efficient improvements to a primary residence. |

Tax Deductions

Tax deductions help lower a taxpayer’s taxable income, which in turn reduces their tax liability. Common tax deductions include:

| Deduction | Description |

|---|---|

| Standard Deduction | A fixed amount that reduces taxable income, available to all taxpayers who don’t itemize. |

| Mortgage Interest Deduction | Allows homeowners to deduct interest paid on mortgages for their primary and secondary residences. |

| Charitable Contributions Deduction | Allows taxpayers to deduct eligible charitable donations. |

| Health Savings Account (HSA) Deduction | Allows taxpayers to deduct contributions to HSAs for qualified medical expenses. |

While tax-saving strategies like tax credits and deductions can help lower tax liability, taxpayers should consider other tax shelters to further optimize their financial situations. By combining these techniques with long-term financial planning, taxpayers can reap the benefits of a lowered tax burden.

Shaping Your Finances with Tax-Efficient Investment Decisions

Financial planning, which incorporates tax-efficient investing and portfolio optimization, is essential for reducing the tax impact on returns. By navigating through tax-advantaged investments and harnessing the power of retirement accounts, you can bolster your tax optimization and retirement planning efforts.

Tax-advantaged investments are designed to provide tax benefits to investors and can lead to substantial tax savings. Examples of such investments include municipal bonds, which are exempt from federal income tax and sometimes state and local taxes, depending on the investor’s state of residence. These tax-efficient investing options should be considered as part of a comprehensive financial strategy.

Another opportunity worth exploring is the 529 college savings plan. These plans allow parents and other relatives to save for a child’s education expenses through a tax-deferred investment account, making contributions tax deductible and qualified withdrawals tax-free. The table below outlines some of the key tax-advantaged investments and their respective benefits:

| Investment | Tax Benefit |

|---|---|

| Municipal bonds | Exempt from federal income tax, and potentially state and local taxes |

| 529 college savings plans | Contributions are tax deductible, and qualified withdrawals are tax-free |

| Health Savings Accounts (HSAs) | Contributions are tax deductible, and qualified withdrawals for medical expenses are tax-free |

| Real Estate Investment Trusts (REITs) | Dividends are often taxed at a lower rate |

The Power of Retirement Accounts in Tax Optimization

Contributing to retirement accounts is a powerful method for tax optimization. Traditional IRAs and employer-sponsored retirement plans, such as 401(k)s, allow for tax-deductible contributions, enabling investors to reduce their current taxable income. These accounts also offer tax-deferred growth, meaning investors face no taxes on investment earnings until they start taking withdrawals during retirement.

Alternatively, Roth IRAs and Roth 401(k)s offer tax-free earnings at withdrawal. Although contributions are not tax-deductible, qualified withdrawals are free of federal income tax, providing a significant advantage during retirement. The table below presents the primary benefits of contributing to both traditional and Roth retirement accounts:

| Retirement Account | Tax Benefit |

|---|---|

| Traditional IRA | Tax-deductible contributions and tax-deferred growth |

| Roth IRA | Tax-free earnings at withdrawal |

| 401(k) and other employer-sponsored plans | Tax-deductible contributions and tax-deferred growth (Traditional); Tax-free earnings at withdrawal (Roth) |

“Tax-efficient investing can significantly enhance your portfolio performance and retirement savings, providing you with a more secure financial future.”

In conclusion, incorporating tax-efficient investing strategies and optimizing your retirement accounts can substantially impact your financial planning efforts. By embracing these methods, you can better shape your finances and prepare for a more prosperous future.

Corporate Strategies for Tax Minimization

In the competitive world of business, corporations constantly seek ways to reduce their tax burden effectively and legally. By employing strategic tax planning and optimizing business structures, companies can significantly minimize their tax obligations while ensuring compliance with the relevant regulations.

How Strategic Business Structures Can Reduce Tax Burdens

Choosing the most suitable business structure is a crucial factor in corporate tax avoidance. There are various types of business structures, each with its own tax implications and benefits. By opting for favorable business structures such as C corporations or S corporations, companies can exploit different tax rates, deductions, and pass-through provisions to achieve the desired level of tax minimization.

Corporations can opt for favorable business structures, such as C corporations or S corporations, to exploit different tax rates and pass-through provisions.

Furthermore, companies can reduce their tax burden by carefully structuring transactions and investing in specific assets. For instance, some types of investment allow businesses to defer taxable income, claim tax credits, or benefit from tax exemptions. The table below presents a comparative analysis of the tax advantages offered by C corporations and S corporations:

| Business Structure | Double Taxation | Pass-through Taxation | Dividends Received Deduction | Capital Gains Tax Rate |

|---|---|---|---|---|

| C Corporation | Yes | No | Available | Varies based on holding period and income level |

| S Corporation | No | Yes | Not Applicable | Varies based on holding period and income level |

As evident from the table, C corporations and S corporations provide unique tax advantages depending on a company’s financial needs and long-term goals. Understanding these distinctions and making informed choices regarding the type of business structure adopted helps in reducing a corporation’s overall tax burden.

By leveraging strategic tax planning, corporate tax avoidance can be achieved legally and efficiently. In the ever-evolving regulatory landscape, staying updated with the latest rules and guidelines, and optimizing business structures for tax minimization, is vital for businesses of all sizes.

Maximizing Deductions Without Triggering Audits

When it comes to maximizing tax deductions, one of the key challenges taxpayers face is finding the balance between reducing tax liability and avoiding audit triggers with the Internal Revenue Service (IRS). This section discusses how to strategically maximize deductions without putting yourself at risk of an IRS audit.

To maximize deductions without raising red flags for audits, it is essential to understand which expenses are deductible and to diligently document them. Over-payment of personal expenses from business accounts may lead to audits. Deferring income or accelerating deductions can also affect taxable income and must be done within the legal limits.

One of the most effective ways to lower your tax bill is by taking advantage of all available deductions. By ensuring that your deductions are within the legally accepted limits, you can substantially reduce your tax liability without raising suspicion from the IRS. Here are some tips on how to maximize deductions while avoiding tax audit triggers:

| Maximizing Tax Deductions | Avoiding Tax Audit Triggers |

|---|---|

| Itemize deductions by identifying eligible expenses | Keep accurate records, with receipts and invoices for each expense. |

| Claim business deductions based on actual expense amounts | Avoid claiming excessive or personal expenses through your business |

| Utilize available tax credits | Double-check eligibility for each tax credit being claimed |

| Defer income or accelerate deductions within legal limits | Do not engage in aggressive shifting of income or deductions |

Maintaining Accurate Tax Documentation

Proper documentation is vital for proving the validity of your deductions and supporting your tax return. To avoid audit triggers, always keep a detailed record of your expenses, including receipts, invoices, and other relevant paperwork. This documentation serves as evidence of the true nature of expenses and helps establish a clear audit trail. Additionally, ensure that your tax documentation is organized and easily accessible in case the IRS requests additional information.

When maximizing tax deductions, it is crucial to stay informed of current audit triggers that might raise red flags. By understanding the nuances of deductions and maintaining meticulous records, you can substantially lower your tax liability without putting yourself at risk of an IRS audit. If you are unsure about the legitimacy of a specific deduction, consult with a tax professional to avoid potential pitfalls and maintain full compliance with relevant tax laws.

The Benefits of Consulting with Tax Professionals

As tax laws become increasingly intricate and challenging to navigate, the expertise of tax professionals becomes an essential aspect of effective tax planning. Particularly for individuals and businesses dealing with complex tax situations, consulting with tax advisors allows them to develop tailored strategies and uncover opportunities for significant tax savings.

When to Seek Expertise for Complex Tax Planning

There are several scenarios where seeking professional tax consultation is advisable:

- Restructuring businesses: Implementing tax-efficient business structures often requires the guidance of experts who can help evaluate the available options and recommend the most optimal course of action.

- New tax legislation: Tax professionals stay up-to-date on the latest tax regulations, helping clients identify how they might be affected by changes and respond appropriately.

- Multistate tax issues: Operating in multiple states can complicate tax planning, with differing state regulations affecting overall tax liabilities. Consulting with advisors can ensure proper management of location-specific tax mandates.

- Foreign investments and operations: Clients engaged in international transactions and investments benefit from the knowledge and advice of tax professionals who understand cross-border tax implications and requirements.

- High net worth individuals: Complex investment portfolios and financial instruments require meticulous tax planning and a thorough understanding of the available deductions, credits, and exclusions.

Regardless of the specific circumstances, tax professionals can navigate the labyrinth of tax laws and regulations to help formulate uniquely tailored strategies and uncover opportunities for significant tax savings. This expertise directly impacts the financial well-being of their clients through a reduction in tax liabilities and a greater understanding of the measures available to legally minimize taxes.

“The hardest thing in the world to understand is the income tax.” – Albert Einstein

Given the inherent complexity of tax laws, enlisting the help of tax professionals ensures resilience against ill-advised tax decisions or inadvertently engaging in illegal evasion schemes. Above all, partnering with tax advisors in complex tax planning provides peace of mind and confidence in the knowledge that one’s tax strategies align with both legal requirements and financial objectives.

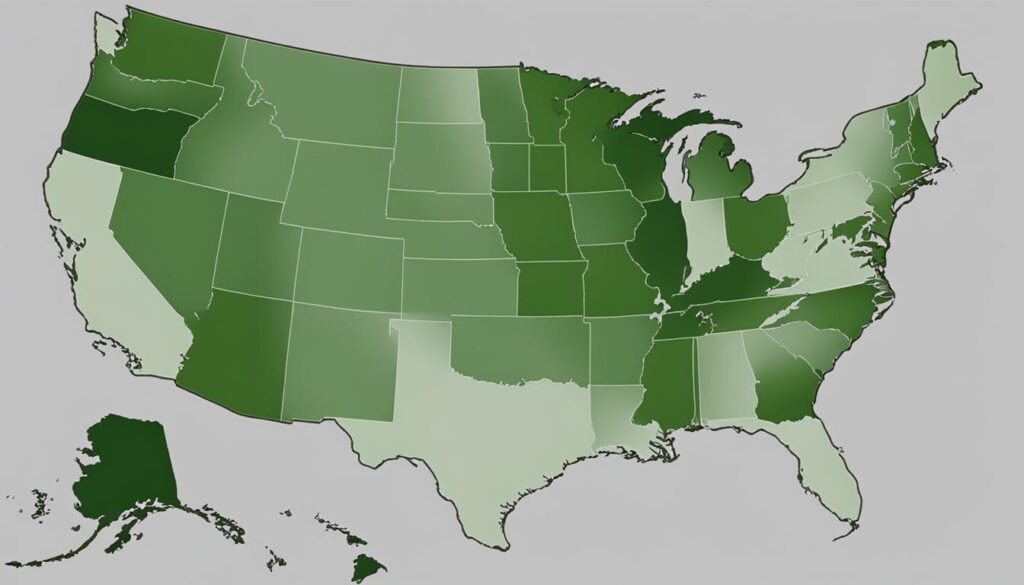

Leveraging State-Specific Tax Regulations for Your Advantage

Different states have varying tax regulations, and leveraging these can lead to tax advantages for both individuals and businesses. By understanding and capitalizing on state-specific tax rules, taxpayers can optimize their tax positions and maximize their financial benefits.

Some states offer lower income tax rates, while others might provide additional deductions or exemptions. To make the most of these opportunities, it is essential to be aware of the local tax planning strategies that can be employed to minimize your tax burden.

“Taking advantage of state-specific tax rules is an integral part of optimizing your tax strategy and maximizing financial benefits.”

Beyond the federal tax rules, each state has its distinct regulations that impact taxpayers differently. For example, while some states impose a flat tax rate, others follow a progressive tax system. Additionally, there are nine states that do not have a state income tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming, Tennessee, and New Hampshire.

Furthermore, it is crucial to understand the state-specific tax deductions and exemptions that might apply to your financial situation. Various states provide generous property tax credits or deductions for qualified residents and businesses, as well as tax credits for certain energy-efficient home improvements or investments in renewable energy sources.

| State | Income Tax Rate | Notable Deductions & Credits |

|---|---|---|

| California | 1% – 9.3% | Qualified Solar Energy System Credit |

| Arizona | 2.59% – 4.5% | Property Tax Relief Credits |

| New York | 4% – 8.82% | Solar Energy System Equipment Credit |

| Illinois | 4.95% | Education Expense Tax Credit |

When looking to leverage state tax regulations for your benefit, consider consulting with tax professionals who specialize in multi-state taxation and local tax planning. They can provide insights and expert guidance on how to optimize your state-specific tax strategies. By staying informed and proactive with your state-specific tax strategies, you can fully embrace the tax advantages offered by each state’s unique tax landscape.

Offshore Tax Havens: Legalities and Limitations

Offshore tax havens have become an attractive option for individuals and corporations seeking legal tax avoidance opportunities. These jurisdictions offer more favorable tax laws and a high level of confidentiality, allowing taxpayers to manage their financial affairs with minimal taxation. However, it is essential to understand the legalities, limitations, and regulatory requirements associated with offshore tax havens to avoid unintentional legal pitfalls in the process.

International tax planning is a key aspect of developing financial offshore strategies. Implementing such strategies within the boundaries of the law is crucial to avoid crossing the thin line between legal tax avoidance and illegal tax evasion. The following points will help grasp the importance of understanding the legal limitations and how to navigate them when considering offshore tax havens:

Legal tax avoidance strategies allow taxpayers to minimize their tax liability through legitimate means, whereas tax evasion refers to illegal practices such as underreporting income and falsifying financial transactions.

Offshore tax havens typically have limited reporting requirements and lower tax rates, which can make them appear as attractive options for corporations and individuals managing substantial wealth. However, not all offshore tax planning is legal, and taxpayers must adhere to specific regulations to ensure compliance with tax laws in their home country.

As mentioned earlier, the distinction between legal tax avoidance strategies and illegal evasion methods is vital when dealing with offshore financial activities. To ensure compliance and avoid potential legal ramifications, consider the following approaches:

- Ensure proper registration with relevant authorities in both your home country and the offshore jurisdiction.

- Maintain transparent and accurate financial records that adhere to international tax guidelines.

- Consult with a professional tax advisor to navigate complex international tax laws.

Offshore tax havens should not be viewed as a one-size-fits-all solution for tax issues. It is crucial to understand the specific requirements and limitations of each jurisdiction and consider the potential legal consequences of non-compliance before making any financial decisions.

| Offshore Tax Haven | Key Features | Limitations |

|---|---|---|

| Cayman Islands | No corporate or personal income tax, strong confidentiality laws | High reputation risk, increased scrutiny by tax authorities |

| British Virgin Islands | Low tax rates, flexible corporate structures, strong confidentiality laws | Growing regulatory pressure, potential future legislation changes |

| Panama | No tax on offshore activities, ease of company formation | Poor global reputation, strict disclosure requirements |

Ultimately, offshore tax havens provide opportunities for legal tax minimization by offering more favorable tax regimes, confidentiality, and flexibility. However, it is vital to remain compliant with all relevant tax laws and regulations. Engaging in professional international tax planning can ensure that taxpayers make informed decisions that adhere to the legal limitations associated with offshore tax havens.

Frequently Asked Questions

What is the difference between tax avoidance and tax evasion?

Tax avoidance involves legally maximizing deductions and credits to lower tax liability, whereas tax evasion entails illegal underreporting of income or falsifying deductions. Tax avoidance is encouraged by Congress, while tax evasion is a punishable offense.

How do IRS regulations play a role in legal tax planning?

IRS regulations provide taxpayers with guidelines on how to legally reduce their tax obligations within the tax code. By understanding and adhering to these rules, individuals and businesses can maintain compliance while minimizing taxes.

Authorized tax loopholes are provisions within tax legislation that allow taxpayers to legally reduce their taxes. These may include certain investments, retirement savings vehicles, and business expenses. Utilizing these loopholes is a compliant way to achieve tax minimization.

Which tax credits and deductions help lower tax liability?

Taxpayers can take advantage of various credits and deductions to lower their tax liability, such as the standard deduction, retirement savings deductions, mortgage interest deductions, and work-related expenses. Credits typically provide more benefit than deductions, as they are subtracted directly from the tax bill.

How can tax-efficient investments help reduce tax impact on financial returns?

Tax-efficient investments, such as municipal bonds, are designed to provide tax benefits to investors. By choosing the right tax-advantaged investments, individuals can strategically minimize tax exposure and protect their financial returns.

What are the benefits of strategic business structuring for tax minimization?

Different business structures, such as C corporations or S corporations, offer companies the opportunity to exploit varying tax rates and pass-through provisions. By carefully structuring transactions and investing in particular assets, businesses can significantly reduce their tax exposure in a legally compliant manner.

How can a tax professional help with complex tax planning issues?

Tax professionals possess the specialized knowledge and expertise needed to navigate complex tax rules and help taxpayers benefit from qualified business income deductions and other intricate provisions. Consulting a tax professional can be especially beneficial in situations where significant tax savings are at stake or when the taxpayer faces complicated tax planning issues.

What are the legalities and limitations regarding offshore tax havens?

Offshore tax havens provide opportunities for legal tax avoidance, given their favorable tax laws and confidentiality. However, tax havens also require adherence to specific regulations and limitations. Understanding the distinction between legal tax avoidance and illegal tax evasion is essential when dealing with offshore financial activities.

The Bottom Line

Effective tax planning plays a pivotal role for individuals and corporations who aim to minimize their tax liability while maintaining compliance with IRS regulations. By understanding legal tax avoidance strategies and making smart tax decisions, taxpayers can enjoy substantial financial benefits.

Deductions, credits, and tax-advantaged investments are some of the primary mechanisms that allow taxpayers to optimize their tax positions. Moreover, strategic decisions in investments, business structuring, and consulting with tax professionals can streamline the process and provide further financial advantages. For example, leveraging state-specific tax regulations and exploring international tax planning opportunities may offer additional tax savings.

It is essential for taxpayers to remain vigilant and avoid crossing into tax evasion territory, which entails serious legal consequences. By staying informed and following the guidance of competent tax advisors, individuals and businesses can navigate the complex world of taxation and capitalize on legal tax avoidance methods to safeguard their finances.