Private banking Switzerland. It’s not just a service, it’s an echelon of financial prowess. For those with substantial assets, it’s not about flaunting wealth, it’s about making it bulletproof. We’re peeling back the curtain on the realm where the phrase “high-net-worth” finds its true home. This is where money isn’t just stored, it’s fortified.

The Unmatched Exclusivity of Swiss Private Banking

Let’s get this straight: Swiss private banking isn’t for the casual saver. It’s for those who view their wealth as not just currency but as capital that demands strategic cultivation. It’s the major leagues of finance. When you step through the doors of a Swiss private bank, you’ve entered a domain where every financial move is calculated with military precision.

Precision at the Core of Swiss Banking

Swiss banks are the Navy SEALs of the financial world. Precision isn’t just a goal, it’s the baseline. They don’t just protect assets, they execute financial missions with the skill of a seasoned sniper. Security here isn’t a concern, it’s a given. Swiss banks are about relentless pursuit of financial optimization – your optimization.

Stability: The Keystone of Swiss Private Banking

Why do the financially astute anchor their assets in Switzerland? One word: stability. Swiss banks aren’t just standing while others falter, they’re the financial equivalent of bomb shelters. They’re not playing the banking game, they’re hosting it on their own terms. This is where wealth isn’t just managed, it’s engineered to thrive through generations.

A Transparent Cloak of Privacy

Gone are the days of secret Swiss bank accounts in dusty vaults. Today, Swiss banking is about lawful discretion. It’s about having the right to privacy without skirting around the edges of the law. Swiss banks today marry the concept of privacy with iron-clad compliance – they play by the rules on a field they’ve mastered.

Private Swiss Bank: The Apex of Wealth Management

Getting to grips with Swiss private banking means accepting it as the heavyweight champion in the wealth management arena. Zurich’s bankers aren’t just watching your back, they’re strategizing your next financial conquest. In Geneva, it’s not just about the money you have, it’s about the legacy you’re building.

When you engage with a Swiss private bank, you’re not just making a deposit, you’re making a statement. This is where financial narratives are not just written but etched into the bedrock of banking history.

The Swiss Banking Experience Decoded

We’re about to take you on a tour of Swiss private banking that strips away the jargon and lays out the facts. Here, every detail matters and every strategy is designed to secure and scale your wealth. Swiss banking isn’t just another financial option, it’s the zenith of private wealth management.

The Legacy of Swiss Banking

Legacy. In the world of finance, it’s not just about what you leave behind, it’s about staying miles ahead of the curve. Swiss private banking is like the old money of Europe – timeless yet always innovating. This isn’t a history lesson. This is a power move in narrative form, tracking how Swiss banks have played the long game and nailed it. Let’s strip down the mythology and get to the core of why Swiss banks are the titans of private banking.

From War Chests to Wealth Management

Back in the day, Swiss banks were the iron vaults in a world of wooden chests. When Europe was tearing itself apart, Swiss neutrality meant stability. It was like they were running a five-star bunker for wealth. While the rest of the continent was playing catch-up, Swiss banks were setting the standard. They didn’t just keep your money safe, they kept it growing, no matter what the world threw at it.

Secrecy Isn’t a Dirty Word

The word “secrecy” gets a bad rap. But in Swiss banking, it’s about discretion with honor. When Swiss banking secrecy laws hit the books, they weren’t just a policy, they were a promise – a promise that here, your financial business is your own. This wasn’t about being shady, it was about providing a shield in a world full of financial arrows.

Standing Strong Through Global Shake-Ups

Ever notice how Swiss banks never seem to sweat? World Wars, economic crashes, market meltdowns – you name it, they’ve faced it. And not only have they faced it, they’ve thrived. That’s the kind of resilience you can’t fake. It’s the kind of stability that doesn’t just reassure, it attracts wealth like a magnet.

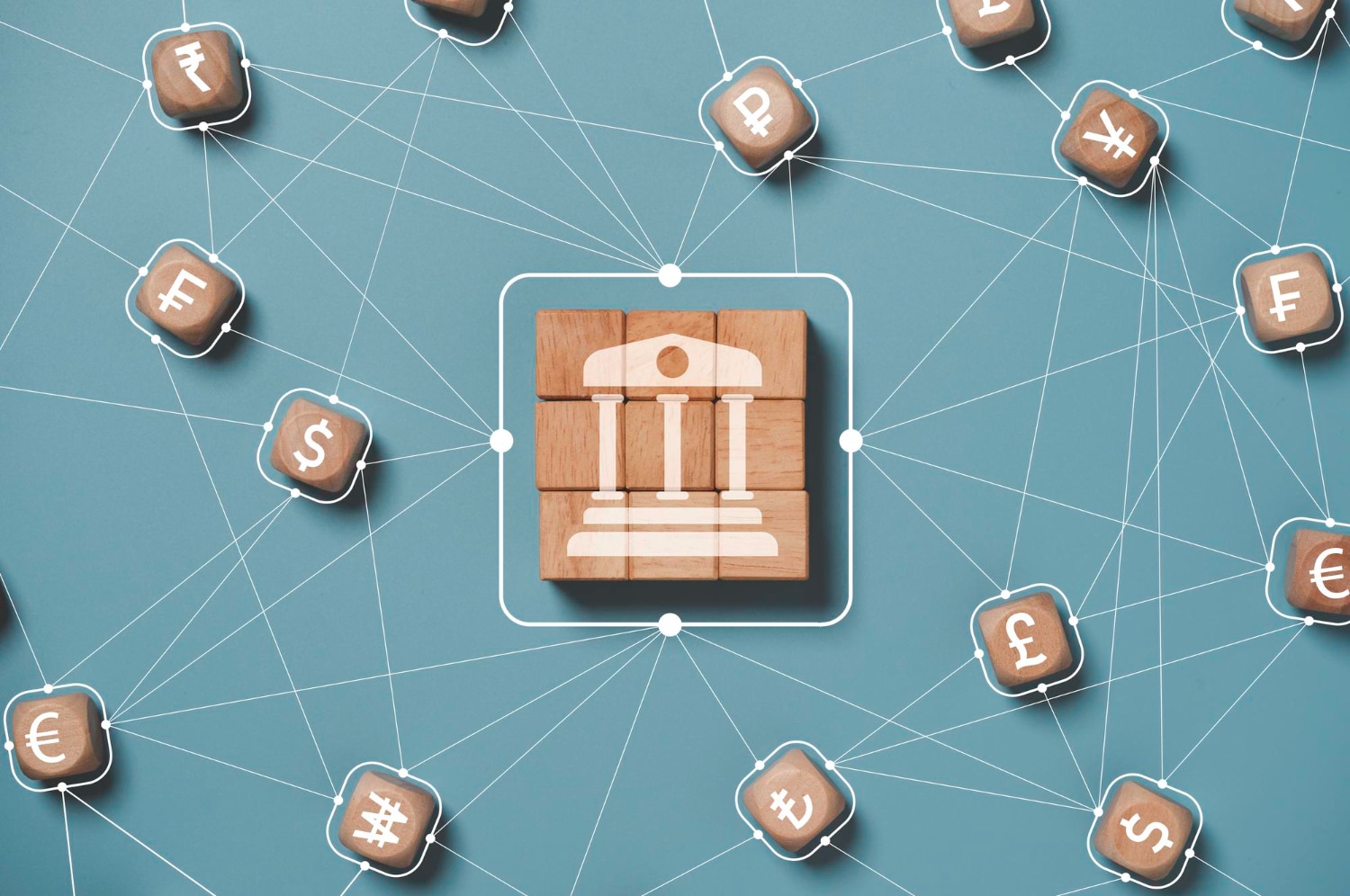

Swiss Banks: The Original Global Financial Hubs

Swiss banks saw the globalization trend coming before it was even a trend. They’ve been international players since before it was cool. This isn’t about having a diverse client base, this is about having the entire world’s elite knocking on your door because they know you’re the gold standard. Literally.

Playing by the Rules and Winning

Let’s get one thing straight: Swiss banks play by the rules – their own rules, which just happen to set the bar for everyone else. When international laws demanded transparency, Swiss banks didn’t just adapt, they revamped the game. Compliance became their new secret weapon. It’s not just about being clean, it’s about being crystal clear.

Innovation is the Name of the Game

Swiss banks could rest on their legacy, but that’s not how they roll. Instead, they’re out there pioneering digital banking revolutions and cryptocurrency integration. They’re the old guard with a new trick up their sleeve, every single day. This isn’t a nod to the future, it’s grabbing the future by the collar and leading the charge.

In the Swiss banking world, legacy isn’t a dusty shelf of history books, it’s the ongoing saga of financial empires being built, protected, and catapulted into the future. Swiss banks don’t just have a story, they are the story – a saga of money, power, and rock-solid reliability that’s still being written today.

Understanding Private Banking in Switzerland

Cut the fluff. When you’re talking about private banking in Switzerland, you’re looking at the Navy SEALs of the financial world. It’s an all-access pass to the kind of financial tools and tactics that would make Warren Buffett do a double-take. This is the realm where fortunes aren’t just made, they’re masterminded.

No Regular Joe on This Client List

Let’s be clear: Swiss private banks don’t do average. They operate in the realm of seven, eight, or nine-figure portfolios. You’re not getting in unless your bank balance has more digits than a phone number. This is the financial equivalent of a velvet rope club where only the ultra-wealthy get a seat at the table.

Customized Financial Couture

Swiss private banks offer a spread of services so tailored and so personal, it’s like your financial DNA is woven into every transaction and strategy. They’re not peddling cookie-cutter advice, they’re crafting a wealth management suit that’s tailored just for you, thread by diamond-studded thread.

Privacy: The Swiss Fort Knox of Finance

Here’s the deal: Swiss private banking is synonymous with privacy. It’s the Fort Knox of personal finance. In a world where data leaks like a sieve, Swiss banks keep your financial secrets locked down tighter than a drum. This isn’t a feature, it’s the cornerstone of their reputation.

The Art of the Investment Ninja

You don’t go to a Swiss bank for run-of-the-mill investment advice. You go there because these guys are the ninjas of the investment world. They see market trends like Neo sees the Matrix – in slow motion, making moves that would leave lesser banks with whiplash.

Networking: The Financial “Who’s Who”

Being with a Swiss bank is like having an all-access backstage pass to the world’s most exclusive concert. It’s not just about growing your wealth, it’s about growing your network. They open doors that don’t even appear on other people’s maps.

Tech-Forward: Banking in the Fast Lane

Swiss banks are where tradition meets high-tech. They’re the Tony Starks of the banking world – blazing trails with tech that keeps your assets as secure as a billionaire’s armor. We’re talking about a tech playground that puts your financial empire on the cutting edge.

Understanding private banking Switzerland is about recognizing you’re not in Kansas anymore. This is where big players play an even bigger game. It’s financial services with a PhD in Wealth Maximization, served up with a side of this is “how you dominate the worl”d.

Services Offered by Private Swiss Banks

When you step into the world of private Swiss banking, you’re signing up for a concierge service in the realm of wealth. It’s not about deposits and withdrawals, it’s about strategizing and capitalizing on every financial front. Let’s pull back the curtain on the kind of top-shelf services that are the bread and butter of private Swiss banks.

Tailored Wealth Management

Think of this as the Michelin-starred meal of financial services. Swiss banks dish out wealth management that’s customized to the nth degree. It’s not just about growing your wealth, it’s about optimizing it, molding it, and making it work like it’s got a mind of its own – a very intelligent mind at that.

Bespoke Investment Strategies

Here’s where private Swiss banks shine like a supernova. Their investment strategies are so tailored, they’re practically sewing them into your financial portfolio one stitch at a time. Whether it’s stocks, bonds, commodities, or unicorn startups, they’re not just managing your investments, they’re architecting empires.

Asset Protection Like No Other

Asset protection? Please, that’s child’s play. Swiss banks do this with their eyes closed and one hand tied behind their back. They’re the masters of shielding your wealth from the unpredictability of life, and they do it with a level of finesse that would make a cat burglar look clumsy.

Tax Optimization – It’s Not What You Make, It’s What You Keep

Swiss private banks know the tax game better than anyone. They’re not just about saving you a few bucks here and there, they’re about strategic maneuvers that keep more of your hard-earned cash where it belongs – with you.

Estate Planning – Your Legacy, Secured

Estate planning with a Swiss bank is like building a fortress around your legacy. They’re not just preparing for the future, they’re carving it in stone, ensuring that your wishes are executed with the precision of a Swiss clock.

Philanthropic Strategies – Giving Back with Impact

Even when it comes to giving back, Swiss banks help you do it with the impact of a meteor strike. They don’t just donate, they create philanthropic strategies that resonate across generations.

Concierge Services – The Red Carpet Experience

Concierge services in a private Swiss bank make a five-star hotel look like a budget motel. They’re not just meeting your expectations, they’re flying past them on a private jet.

Exclusive Private Banking Portals

Think of this as your digital fortress, a place where you can manage your wealth with the click of a button, but with security tighter than Area 51. Swiss banks offer online services that redefine the meaning of exclusive.

In essence, when you’re dealing with a private Swiss bank, you’re not just a client, you’re royalty. They’re not providing services, they’re crafting experiences. They’re not just managing your money, they’re elevating your entire financial existence to a level where the view is nothing short of spectacular.

The Mechanics of Private Banking Switzerland

You want the nuts and bolts? Here’s the unvarnished truth about what makes private Swiss banking the heavyweight champion of the financial world. It’s like peering under the hood of a supercar – intimidating yet supremely awesome.

Getting on the Inside – More Exclusive than the VIP List at a Vegas Club

Let’s talk client intake. You don’t just walk in, you get ushered into a world where every financial move is a power play. Swiss banks don’t deal with numbers, they deal with narratives – your financial saga, spelled out in dollars and sense.

Secrecy – Your Business is Nobody’s Business

In the world of Swiss banking, discretion isn’t just promised, it’s embedded in their DNA. It’s like Fight Club for your finances – the first rule of Private Swiss Bank is: you do not talk about Private Swiss Bank.

Risk Isn’t a Four-Letter Word

Risk management? Swiss banks play the game like grandmasters. They turn risks into choreographed moves that would make a ballet dancer look clumsy. They’re not avoiding risks, they’re taming them.

Investment Gurus, Not Committees

The investment committee? Please. That’s a council of wizards, each with their own financial crystal ball. They’re not just advising, they’re orchestrating your wealth symphony.

Tech Like It’s 3023, Not 2023

Tech in a Swiss bank isn’t just state-of-the-art, it’s next century. Cybersecurity so tight, it makes Fort Knox look like a lemonade stand. They don’t follow tech trends, they set them.

Reporting – Forget Statements, Think Holograms

Client reporting is less about delivering numbers and more about delivering insights. Swiss banks give you a financial narrative that’s more gripping than your favorite thriller – with the added bonus of making you richer.

Regulatory compliance is a ballet, and Swiss banks are the principal dancers. They don’t just comply with laws, they waltz through them with a grace that’s borderline supernatural.

Not Just a Banker, Your Financial Confidant

The personal touch? That’s the secret sauce. Your banker isn’t just a banker, they’re your confidant, your ally, your financial battle buddy.

Swiss private banking isn’t just about being posh, it’s about being precise, powerful, and personal. It’s not a service, it’s a partnership. And they don’t just handle your money, they handle your legacy. They’re not playing the game, they’re changing it.

The Benefits of Banking with a Private Swiss Bank

Let’s slice through the fluff and hit the core of why banking with a private Swiss bank isn’t just a good idea – it’s a game-changer. This isn’t just about having a place to stash your cash, it’s about unlocking a universe of benefits that’s reserved for those in the know. We’re not selling dreams here, we’re talking hardcore, tangible perks that make a difference.

When you join the ranks of those who bank Swiss, you’re not just getting an account, you’re getting an all-access pass to the financial equivalent of Valhalla. Let’s tear into this like a Spartan going into battle.

Fortress-Level Security – Your Money’s Personal Bodyguard

First up, let’s talk security. It’s not just strong, it’s Swiss-bank strong. Your assets are locked down tighter than the vault at the Tower of London. Hacking into your account? It’s easier to break into the Pentagon bare-handed.

Discretion – Swiss Banks Invented the Term

Then there’s discretion. Swiss banks don’t just promise discretion, they deliver it like Domino’s delivers pizza – fast, efficient, and without asking questions. Your financial affairs are Fort Knox-secret.

Global Power Moves – Your Passport to International Finance

Diversification? Please. Swiss banks wrote the book on it. You’re not just opening an account, you’re opening doors across continents. You’ve got a global toolkit to make moves like a financial James Bond.

Asset Protection – Like a Financial Bomb Shelter

Asset protection isn’t just a service, it’s a Swiss pledge. Economic turmoil? Market crash? Your assets are riding out the storm in a bomb shelter.

The Network – Join the Club of the Elite

Networking isn’t an afterthought, it’s a cornerstone of the Swiss banking experience. You’re not just a client, you’re a member of the most exclusive club in the world.

Top-Shelf Investment Advice – Forget Whiskey, This is the Good Stuff

Investment advice from a Swiss bank isn’t garden-variety tips, it’s the Michelin-starred meal of financial guidance. Tailored, strategic, and so cutting-edge you might need a band-aid.

Wealth Management – It’s Like Having a Personal CFO

Swiss banks don’t just manage your wealth, they curate it. You’ve got a team of financial masterminds strategizing your every monetary move.

The Tech Edge – Living in the Future, Banking in the Present

And let’s not forget the tech. With a Swiss bank, you’re not just online, you’re on the frontier. They’re leveraging tech that would make Silicon Valley blush.

Tax Optimization – Playing Chess with Tax Codes

Tax optimization is not a murky grey area, it’s white-hat wizardry. Swiss banks don’t bend rules, they just know them better than anyone else.

Legacy Planning – Because Immortality is Overrated

Lastly, there’s legacy planning. Swiss banks aren’t just looking at your life span, they’re looking at your dynasty. You’re not just passing on wealth, you’re building an empire.

Each of these benefits isn’t just a line item, it’s a doorway to a new dimension of financial supremacy. When you bank with a Swiss private bank, you’re not just ticking boxes in a sign-up form, you’re scripting the next chapter of your financial saga. There’s no “fine print” here – just bold, capital letters spelling out SUCCESS. That’s Grady way of saying, “Welcome to the top.”

Challenges and Misconceptions

When it comes to Swiss private banking, the hype is louder than a rock concert. But let’s cut through the noise and get to the guts of it. This isn’t a fairy tale land of secret vaults and unlimited wealth – it’s a battlefield where only the savviest survive. Let’s break down the real talk on what it takes to bank Swiss, no fairy dust or wishful thinking included.

The “You Gotta Be Rich” Myth

Think Swiss private banking is reserved for the champagne-and-caviar crowd? Time to flip the script. Swiss banks are welcoming savvy investors from all walks, not just those who summer in St. Moritz. Let’s get real – it’s not about flaunting a mega-yacht, it’s about smart financial fortification for your hard-earned cash.

Swiss banks have evolved, they’re not the old boys’ club anymore. They’re on the lookout for the go-getters, the disruptors, the movers and shakers of today’s economy. If your bank account doesn’t rival a small country’s GDP, no stress. It’s your growth potential that has Swiss bankers taking notes.

The value proposition here is not about secret accounts for the obscenely wealthy. It’s about creating a financial stronghold that protects and grows your assets. Swiss banking now is synonymous with smart banking – it’s transparent, strategic, and offers a partnership approach. They’re banking on your future success, not just your current net worth.

So here’s the straight talk: If you’re building wealth with innovation and intelligence, Swiss banking is in your corner. It’s no longer about the wealth you have but the wealth you’re capable of creating. And in this revamped banking narrative, it’s the smart wealth that wins.

The Compliance Gauntlet

Here’s the game nobody tells you about: Swiss banks are a fortress, and to get in, you gotta run the compliance gauntlet. It’s tough, no joke. Regulations are tighter than a new iPhone’s security, but that’s the price for top-shelf financial secrecy and safety. You wanna play in this league? Lace up, and get ready to play by the book.

“All Swiss Accounts Are Covert” – Busted

Let’s burst this bubble right now: the days of cloak-and-dagger banking in Switzerland are over. Transparency’s the new black in Swiss finance. Swiss banks are cleaner than your grandma’s kitchen floor – legit, upfront, and clear as day. No more shady business, it’s all about legit wealth management with a privacy shield that’s legal and solid.

Premium Service, Premium Price

Final reality check: world-class service ain’t a dollar menu deal. Swiss banking is like that high-roller suite in Vegas – exclusive, with a price tag to match. But you’re not just throwing cash into a money pit, you’re investing in financial armor that’s bulletproof. It’s about ROI that would make Wall Street weep. Yeah, it’ll cost you, but what you get back in security, growth, and power is worth every penny.

There you have it, stripped down and straight up, no punches pulled. Swiss private banking is a titan’s game, and it’s all about playing it smart, tough, and with eyes wide open. Forget the tall tales and the whispered rumors. It’s time to get real about the challenges and cut through the fluff. If you’ve got the grit and the wit, the world of Swiss banking is your playground.

Future Trends in Swiss Private Banking

Let’s cut through the noise and get down to business – Swiss private banking isn’t stuck in the 19th century. It’s all about blockchain-powered security, cryptocurrency portfolios, and AI-driven financial advice. Imagine managing your Swiss bank account while you’re in line for coffee – all from your phone. Swiss banks are redefining the game, offering a level of convenience that used to be the stuff of sci-fi.

Going Green: Banking with a Conscience

It’s not just about making bank anymore, it’s about making a difference. Swiss private banks are going all-in on sustainable investing. They’re proving you can build wealth while building a better world. It’s a win-win: solid returns and a planet that’s not going up in smoke. If you’re not thinking about green investments, you’re living in the past.

Information is Power: The New Era of Client Intelligence

Knowledge is not just power – it’s profit. Swiss banks are dishing out insights like hotcakes, and clients are eating it up. The days of “trust me, I’m your banker” are gone. Now, it’s about transparency and education. Swiss private banks are transforming clients into financial wizards, equipped with the knowledge to call the shots on their wealth.

Borderless Banking: Swiss Precision Meets Global Ambition

The Swiss are tearing down the borders, and not just in the Alps. We’re talking global financial strategies that cater to the jet-setters and multinational moguls. Swiss private banking is offering a first-class ticket to international investing, tapping into markets that are hotter than a Swiss sauna.

Tailored Wealth: Your Financial Fingerprints

Personalization is king. Swiss banks are handcrafting financial experiences that fit your life like a tailored suit fits a CEO. They’re moving past the cookie-cutter formulas and diving into bespoke wealth strategies that mirror your unique financial DNA. They’re not just managing your money, they’re architecting your financial empire.

Ditching the Red Tape: High-Flying Financial Freedom

Time to shred the rulebook – Swiss private banking is about cutting through the bureaucratic red tape and giving clients the freedom they’ve been craving. You’re not just opening an account, you’re unlocking a realm of possibilities where your voice counts. You call the shots, and the bankers? They’re more like your financial co-pilots, there to navigate the nitty-gritty and keep your assets soaring high without hitting turbulence.

Privacy is King: Your Financial Fortress

Let’s talk about a fortress, not the kind with towers and moats, but one that guards your wealth. Swiss private banking is the Iron Man suit for your finances, offering privacy levels that make Fort Knox look like a fishbowl. This isn’t just about keeping prying eyes away, it’s about creating a sanctuary where your financial plans can thrive away from the limelight and the noise.

White-Glove Service: Not Just a Perk, But the Standard

Ever felt like just another account number? Kiss that goodbye. In the world of Swiss private banks, white-glove service isn’t a perk – it’s the gold standard. From bespoke investment strategies to personal wealth managers who know your financial dreams better than you do, this is about high-octane, personalized service that puts you on the pedestal you deserve.

The Speed of Swiss: Efficiency in Every Transaction

Ever wonder why Swiss watches are the pinnacle of craftsmanship? It’s all about precision and efficiency – the same principles Swiss banks apply to every transaction, every investment, and every client interaction. You want to move fast, make waves, and not be bogged down by sluggish processes. Swiss private banks get that, and they’re engineered to match your pace.

Beyond the Vault: Adventures in Wealth

Opening a Swiss bank account isn’t the endgame – it’s just the beginning of an adventure in wealth. The client experience is about exploring opportunities that stretch from the cobblestones of Zurich to the skyscrapers of Singapore. Private Swiss banks are your ticket to a world where wealth isn’t just about stockpiling cash – it’s about experiences, growth, and carving out a legacy that’s as enduring as the Alps themselves.

With a focus on client empowerment, privacy, personalized service, efficiency, and the broad spectrum of opportunities, this outline component encapsulates the premium nature of the Swiss private banking experience. It’s designed to inform and excite prospective clients about the unparalleled advantages they can expect. If this resonates with the direction you want to take, let me know if we should lock this in or tweak it further.

Private Banking Beyond Zurich and Geneva

Think Swiss banking, and your mind probably leaps straight to Zurich or Geneva, right? Well, strap in, because we’re about to take a detour off the beaten track. There’s a whole constellation of Swiss private banks nestled in places like Lugano, Bern, and Lucerne that are just as swanky, just as secure, and dripping with that elite Swiss banking prowess. These hidden gems offer the same sterling service, sans the echo of the mainstream hustle.

Local Expertise, Global Reach

Here’s the thing: Swiss banking’s excellence isn’t confined within the walls of a city. It’s the spirit of Swiss precision and discretion woven into the very fabric of their culture. Banks outside the Zurich-Geneva axis are not playing catch-up, they’re full-fledged maestros orchestrating global financial symphonies with local expertise. They bring a personalized touch that’s hard to beat, connecting local charm with a network that spans continents.

The Lugano Connection: Where Italian Flair Meets Swiss Efficiency

Welcome to Lugano, where the Swiss precision you love meets the Italian passion you can’t live without. It’s an unorthodox mix that spells out more than just a banking haven – it’s a lifestyle. The Lugano private banking scene is vibrant, to say the least, where bankers are as savvy with numbers as they are with a glass of fine Merlot.

The Bern Bonus: Capital Gains in the Capital City

Bern isn’t just about bears and cobblestone streets, it’s a powerhouse of financial acumen waiting to be unleashed. The banks here might not scream “high-profile”, but they whisper “high-performance”. In the Swiss capital, private banks play a long game, building fortunes with a strategy that’s steady, solid, and stunningly effective.

Innovation in Lucerne: Where Tradition Meets Tomorrow

Lucerne is where tradition gets a turbocharge of innovation. You think you know Swiss banking? Lucerne will make you think again. This picturesque town isn’t just for postcards, it’s for spreadsheets and portfolios that are as forward-thinking as they are rooted in time-honored Swiss banking practices. Lucerne’s banks are not just about managing wealth, they’re about redefining it for a new age.

The Role of Innovative Products in Private Swiss Banking

Gone are the days when Swiss banks were just vaults with pretty doors. Welcome to the era where innovation is as Swiss as the Alps. This isn’t your grandpa’s private banking scene – we’re talking cutting-edge, trend-setting financial products that’ll make you sit up and take notice. It’s all about staying ahead of the curve, and Swiss banks are hitting the gas pedal on innovation.

The Digital Gold Rush: FinTech and the Swiss Edge

Get this: FinTech in Switzerland isn’t just growing – it’s exploding. Swiss private banks are leading the charge, melding their rock-solid traditions with Silicon Valley swagger. From blockchain breakthroughs to digital wealth management platforms, Swiss banks are offering up a digital gold rush for those looking to strike it rich in the tech-forward finance world.

Bespoke Banking: Tailored Financial Solutions for the Discerning Client

One-size-fits-all? Please, that’s so last century. Swiss private banks are the tailors of the financial world, stitching together bespoke financial solutions that fit each client like a glove. Want a portfolio that aligns with your values? Done. Looking for a private placement annuity that’s as unique as your financial goals? You got it. Swiss innovation is about personalization taken to the nth degree.

The Rise of PPLI: A New Haven in Wealth Management

Private Placement Life Insurance (PPLI) is turning heads, and for good reason. This isn’t your average insurance product – it’s a wealth management powerhouse dressed up in a policy’s clothing. Swiss banks are leveraging PPLI to offer savvy investors a tool that marries tax efficiency with investment flexibility, making it a go-to for those in the know.

Sustainable Investing: The Swiss Route to Green Wealth

The Swiss have taken sustainable investing and turned it into an art form. Private Swiss banks are at the forefront, pushing products that not only benefit your wallet but also the planet. Eco-friendly investments are not just a trend – they’re a testament to Switzerland’s commitment to being as green as their countryside, and private banks are your guide to this verdant financial landscape.

Frequently Asked Questions

What Exactly Is Private Banking in Switzerland Known For?

You know the deal: When you hear “Swiss private banking,” your mind probably jumps to vaults tougher than a tank and secrecy tighter than a drum. But here’s the real juice – it’s about hyper-personalized banking. Swiss private banks roll out the red carpet with bespoke services like wealth management, tax optimization, and investment advice that’s tailored sharper than a Savile Row suit. They’re like the personal trainers of the finance world, pushing your wealth to heavyweight status with a mix of old-school discretion and cutting-edge financial strategies.

Can I Open a Private Swiss Bank Account Without Being Super Rich?

Cut the myth – private Swiss bank accounts aren’t just for the Bruce Waynes of the world. Yes, they used to be the playground for millionaires only, but times are a-changin’. Now, even if you’re not swimming in Scrooge McDuck money, you can get a slice of the action. The entry barrier has lowered, but you still need to show you’re serious about growing your wealth. If you’ve got the ambition and a decent starting point, Swiss banks are listening. They’re in it to amplify your financial game, not just cater to old money.

How Safe Is My Money in a Private Swiss Bank?

Let’s get one thing straight: Swiss banks are Fort Knox safe. Your money’s not just sitting pretty, it’s locked down tighter than the federal gold reserve. Switzerland’s got a rep for political and economic stability that’s as solid as the Alps. Plus, they’ve got legal frameworks that treat your cash like the crown jewels – strict confidentiality and protection. It’s like having a personal security detail for your dough, except it’s all done through meticulous Swiss financial laws and unmatched banking discretion.

What Are The Advantages of Swiss Private Banking?

Imagine banking where you’re not just another account number – you’re the MVP, and the bank is your dedicated support team. Swiss private banking’s got the edge with tailor-made financial strategies and a level of service that regular banks can’t touch. They’re throwing in everything but the kitchen sink – exclusive investment opportunities, tax optimization, estate planning, and even lifestyle services. It’s about giving you the power moves to boost your wealth status. Think of it as upgrading from coach to first-class, once you experience it, you’re not settling for less.

What is the minimum deposit for Swiss private bank?

Alright, let’s cut through the fluff. You’re not buying a candy bar here, we’re talking Swiss private banks. There’s no one-size-fits-all answer, but here’s the lowdown: you’re likely looking at a minimum of six figures in either USD, CHF, or EUR. Some banks might roll out the red carpet for less, but if you want the full fat of premium services and those sweet investment opportunities, you better be ready to play ball at the high stakes table. It’s not about flashing cash, it’s about showing you’ve got skin in the game to build that wealth empire.

Does Switzerland Have Private Banks?

Of course, Switzerland has private banks, and not just any banks, we’re talking the Rolls Royce of banking here. This is the land where private banking isn’t just a service, it’s an art form. Swiss banks are like a haven for wealth management, so much so that they’re practically synonymous with the term “private banking.” They’ve been playing this game since the 1700s, so you can bet they’ve perfected every move on the board.

What is the best private bank in Switzerland?

Now, this is where it gets spicy. Choosing the “best” Swiss private bank is like trying to pick the best vintage wine – it comes down to your taste. You’ve got giants like UBS and Credit Suisse that bring the brand power and international clout. Then there’s Julius Baer and Pictet, which are like your specialized boutiques, offering that personalized touch. What’s best? It’s all about what suits your financial palate. Want global reach or a bank that knows you by your dog’s name? Swiss banking’s got a flavor for every investor.

The Bottom Line: Private Banking Switzerland

We’ve toured the Swiss financial fortress, taking in the views from private banking’s peak. It’s not just about stashing cash in a numbered account, it’s a dynamic financial playground. Swiss private banking is the stuff of legends, and for those in the loop, it’s as real as the money they count.

Beyond the Vault: The Swiss Private Banking Journey

Look, Swiss banking isn’t just a pit stop, it’s a journey. And not just any ol’ trip, but a voyage through a realm of financial wizardry where the maps are drawn in ledgers, and the compass points to profits. It’s a blend of tradition and innovation, where the banks aren’t just banks, but gatekeepers to a fiscal wonderland.

The Secret Sauce: What Makes Swiss Banking Tick

Ever wondered what the secret sauce of Swiss banking is? It’s a concoction of discretion, expertise, and a sprinkle of that old-world charm. Add a dash of modern tech, and you’ve got a recipe that’s as potent as it is exclusive. Swiss private banking isn’t just about being private, it’s about being premier.

Looking Ahead: The Swiss Banking Horizon

Eyes on the horizon, because the Swiss banking scene is on the move. It’s not standing still – it’s scaling the financial Alps, seeking out new summits. Whether it’s crypto custody or bespoke wealth management, Swiss banks are pacing the trail for the rest to follow.

Takeaways: Carving Your Path in Swiss Banking

So, what’s in it for you? Carve your path in the Swiss banking landscape, and you’re not just a client, you’re part of a legacy. Whether it’s securing your wealth in a private swiss bank account or investing in a private placement annuity, you’re grabbing a piece of financial history and steering it into the future.